When it comes to your 401(k) investments stocks are where the money is at. Yet the best strategy for getting the most bang for your buck has you investing in stocks only when odds of hitting a home run are firmly in your favor.

When it comes to your 401(k) investments stocks are where the money is at. Yet the best strategy for getting the most bang for your buck has you investing in stocks only when odds of hitting a home run are firmly in your favor.Let's broaden your command over that unique power your 401(k) puts at your fingertips. There's more you need to know beyond the five minutes per month it will take to stay on top of risk that could knock you out of the game.

First, you need to focus on those 401(k) fund alternatives investing your savings 100% in stocks (and nowhere else like, say, bonds). Why? Because history demonstrates stocks offer superior investment returns. So why even consider any alternative whose record compared to stocks is a history of inferior performance?

Of course, there often are practical considerations clouding the view "history" is suggesting. That is why you should be extraordinarily sensitive about risks investing in stocks. Stocks might be history's best investments, but what is known to happen over the long-term might not, for whatever reason, coincide with your lifetime. So, managing your risks investing in stocks is imperative, if history is to be any reliable guide.

Now, no matter which investment strategy you engage, there always are going to be assumptions about the future you will be making by default. My 401(k) investment strategy assumes the world will proceed in a similar fashion as has gotten us to this point. There will be ups and downs — booms and busts — just like has occurred before. Therefore, as a rule diversify investments in your 401(k)'s stock funds — that is switch from Plan B to Plan A — only when risks are reduced.

When risks investing in stocks are reduced there's a rising tide positively affecting the stock market. Diversification helps assure you profit from this rising tide. As they say, a rising tide lifts all boats, so you simply must have many boats on the water. That's why you diversify. This will increase your odds of earning a return that keeps pace with averages like the S&P 500. Diversify and the "home run" you are swinging for is better assured.

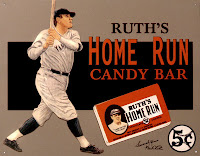

Taking the past thirty years as a guide, the strategy I am suggesting here could have you beating the S&P 500 (an industry benchmark most professionals fail to best), making you the Babe Ruth of 401(k) investing. Now, what I term "hitting home runs" investing in stocks simply involves knowing when to swing for the fence: when to move your accumulated 401(k) savings into attack mode. It is all about patiently waiting for the wind to be blowing out of the park.

So, the "why" of investment diversification is explained by the fact that, a rising tide lifts all boats, whereas the "when" comes with patient verification there's a favorable wind blowing in the stock market.

No comments:

Post a Comment